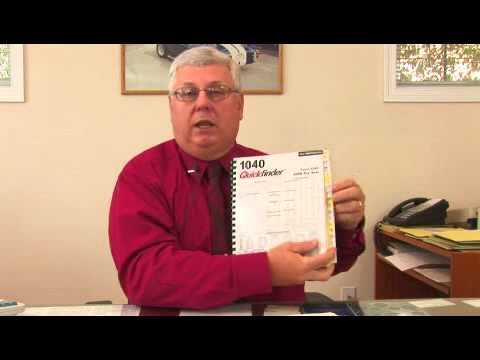

How to fill out tax forms is a complex issue. To deal with this, the first thing you should do is organize all your receipts and income items into different pockets. You need to understand that wages go on one line, while interest and dividends go on a different line (such as Schedule B). Different items go on different schedules. This is where resources like the 1040 quick finder book come in handy. It has tabs that describe line by line items and what each schedule is for. For example, Schedule A includes itemized deductions like mortgage interest and real estate taxes. Schedule B includes interest income and dividends. Schedule C is for self-employed individuals and includes business income and deductions. Schedule D is for investment gains and losses, whether it's stocks, bonds, or investment property. Schedule E is for rental income. Page 1 and Page 2 have other items related to partnerships, S corporations, and farming. Schedule SE is for self-employment taxes. The quick finder book has a tab for each schedule, making it easy to refer to. Alternatively, JK Lasser and local bookstores offer similar resources with line by line instructions. The IRS also provides publication 17 and publication 334 as instructions. Once you understand the schedules (ABCDE), you then move on to the forms. For example, Form 2106 substantiates business losses and expenses, which may go to your business or itemized deductions. Form 4797 is for the sale of business property, which goes to Schedule D and then to page 1 of Form 1040. Understanding all these components is crucial for correctly filling out tax forms. You need to know which line each item belongs to. The numbered forms substantiate what is on Schedule A, B, and C before it all ends up on page 1 of...

Award-winning PDF software

Pa-40 2024-2025 Form: What You Should Know

The tax return due date for 2025 is 30 days after the due date in 2021. If the tax return for 2025 is filed under the Pennsylvania Tax Code, there is no tax due date. If the tax returns for 2019, 2019A and 2019B are filed under tax code 18.2-305.1, the tax due dates are March 17th and May 7th of the fourth year following the year of the return. For example, if the 2025 tax return is due on March 17th, the 2025 tax due date is May 7th. If the 2025 tax return is due on May 7th then the 2025 tax would be due on March 17th. The Pennsylvania Tax Code 18.2-305.1 contains an assessment provision. If an assessment is made, the taxpayer may be assessed a penalty of 2 percent of the amount of taxes due for each day he fails to file a return of tax due. Also, there is a penalty equal to 1.5 percent per month, beginning at the end of the year. If you have any questions about filing the form, feel free to call me at 215.722.4333 or complete the online tax form. Please fill out this form and mail to: PA Pennsylvania Department of Revenue Attn: Pennsylvania State Tax Bureau P. O. Box 528 Harrisburg, PA 17 2021 Personal Income Tax Forms Overview 2021 PA Tax Forms: Overview of the 2018/2019 Form(s) you should include. The most common error is not including the PA State tax information. Please complete tax forms under PA tax code 18.2-305.1. 2021 PA Tax Forms: A summary of the tax forms. The following summary forms are the most frequently used: PA State Income Tax Returns, Pennsylvania Exemptions / Credits, PA Tax Forms, etc. 2021 PA Tax Forms Overview Pennsylvania's income tax rate for 2018/2019 is: 3.07 percent (or 0.0307 percent). Pennsylvania gives tax credits and exemptions to various residents. 2021 PA Tax Forms Overview PA tax code 18.2-305.1 provides a series of assessments and penalties. 2021 Individual Income Tax Returns: Introduction. The following individual income tax return(s) will be accepted: Pennsylvania Individual Income tax return. 2021 PA Tax Forms Overview Pennsylvania tax code 18.2-305.1 provides deductions and credits.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8453-F, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8453-F online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8453-F by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8453-F from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Pa-40 2024-2025