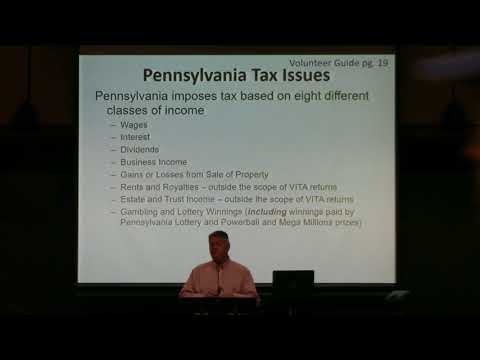

All right, well welcome back everyone! As Esther mentioned, tonight we're going to be talking about state and local income taxes and also the Affordable Care Act. So if you have questions, feel free to address them at any point in time. What we're going to be looking at today is a nice overview of how state and local taxes are going to be handled within the scope of Ida. The goal is to walk through common situations and things that you'll be seeing within the sites. We'll also talk about how some things may be a little different from what we've discussed over the past couple of weeks. Specifically, we'll discuss filing requirements and how income may differ from federal. If you have questions related to bytom, we'll let you know if they're typical ones that we see within our program. If they're more complex, we can take the time at the break or after this session to go through them in more detail. So let's dive right in and start off with state and local income tax. One of the differences is that we no longer use the forty twelve for state and local income tax, since the IRS now only covers their piece, the 1040. Instead, we have some additional information in your volunteer guide. The guide contains several pages that will go through the state and local issues we'll be discussing tonight. In the past, we referred to a tab in the forty twelve. But tonight, we'll be referring to your volunteer guide for additional information. Firstly, let's take a look at the filing requirement. It's similar to how we started off our initial IRS session when we discussed filing requirements for federal income tax. For Pennsylvania, the only thing we'll be looking at is whether...

Award-winning PDF software

What is pa-8453 Form: What You Should Know

It is a non-electronic filing form. It is also not necessary to send to PA Department of Revenue unless the state department has lost the information. Form PA-8453 is required by the PA Dept of Revenue as proof of PA income tax, and the required format for electronic filing of a Pennsylvania Individual Income Tax Return. We also will need to show our employer income tax that should be shown on a payroll stamp. PA Form PA-8453 must be completed for Electronic Filing and maintained for three years. Do not send Form PA-8453 to PA Our employer does pay for the Pennsylvania Individual income tax withholding by a payroll card. We will need to make sure that our employer gets notified that there has been an error in our credit card or payroll tax withholding information and needs to be correct on the Pennsylvania return for our paycheck. PA-8453 is for an individual who does not receive a Social Security number. For this individual, it does not matter what the Social Security number is, so the only information that is used is the name and Social Security number number and that name and social security is the name of the individual in the tax return and not Social Security number. However, the Social Security number must be on the federal Form W9. PA income tax, if you have an online account, if you have an account, and you do not have an account with the PA Department of Revenue, you can create an account with the Pennsylvania Department of Revenue. Visit to check the status of your account. If you have an online account with the PA Dept. of Revenue, but the state Department of Revenue does not have your Social Security number you can create your own account on their site at. If you have an online account with the PA Dept of Revenue, you can pay your state and federal income tax online in a matter of minutes using taxfiler.com. Once your online payment is complete (that's 3-5 business days), you will be able to download and print your federal tax return and send it to the Pa Dept of Revenue to be processed and mailed.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8453-F, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8453-F online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8453-F by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8453-F from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing What is form pa-8453