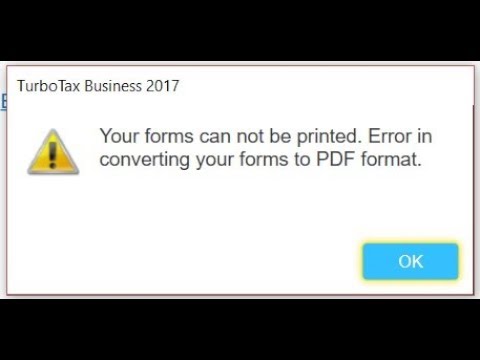

Hi guys, welcome to this video about a problem I encountered while filing my taxes in the USA. If you have the same issue, I might be able to give you some advice. The tax filing software I used is TurboTax Business, which is specifically for businesses. If you're doing your taxes on your own and not using a CPA, the deadline has already passed, which was March 15th. However, many people file for an extension, which allows them more time. If you choose to file an extension, you will likely run into the problem I faced. The issue is that the IRS forms cannot be printed directly. Instead, you need to convert them to PDF format. So basically, you fill in all the information, go through the steps to file your tax return, and then you reach a page that shows "Federal Tax Accepted." However, you are not done. You need to click on "Continue," and it will prompt you to print additional forms and instructions. Your printout will include any additional forms required by the government to complete your return. It doesn't explicitly state that you need to mail anything, but it seems to imply that you do. Further explanation on the same page mentions that even if you file electronically, there may still be some paper forms you need to print to ensure that your return is complete. Though it doesn't specifically say to mail them, it seems like they do need to be sent by mail. The forms may be related to payment or payment vouchers, but in my case, I didn't have any payments to make. One important form to be aware of is the 8453 form. Whenever you e-file, you have to print this form and send it by mail to the IRS. It is used for...

Award-winning PDF software

What is the 8453 Form: What You Should Know

U.S. Individual Income Tax Transmittal for an Individual. California Department of Finance. How Form 8453 Works & What is it Used For Form 8453 is used to electronically file federal income tax returns for individuals on tax-filing dates in the following tax years: 2018, 2019, 2025 and 2021. Form 8453 will not be provided for e-filing purposes after 2025 unless you are eligible for e-file and submit your tax return before the deadline listed above. For more information, see: Form 8453 Form 1120 Self-Employment Tax Return Form 1120 Self-Employment Tax Return. Dept. of the Treasury. The Form 1120 Self-Employment Tax Return provides information regarding payments of social security and state and local taxes. Form 1120 Self-Employment Tax Return. Dept. of the Treasury. For more information, see: Form 8453 – 2025 Form 1040 Form 8453 is used to electronically file federal individual income tax returns for 2018. The 2025 and 2025 Form 1040 Forms 8453 will be discontinued on April 17, 2018. The Form 1040 for 2025 will be issued on or before July 1, 2018. Form 8453 is not required on the following tax-filing dates for 2018: • April 17, 2025 (Self-employed) • July 1, 2025 (Self-employed) Form 8453 – 2025 IRS 2025 Tax Return In 2016, the IRS began issuing Form 8453 as the alternative to the self-employment return. The Form 8453 can be used for tax filers who: • File a “business activity” with the IRS • File their self-employment return on Forms 1040, 1040A, 1040EZ and 1040NR-EZ For more information, see: Form 8453 – 2025 IRS 2025 Self-Employment Tax Return The self-employment tax return can be filed for taxpayers with certain business activities as listed below: • Employs over 100,000 employees (not limited by the number of people in the business) • Paying over 100% of the tax due • Filing Form 1040 and Form 1040A The self-employment tax return contains personal information for each individual taxpayer on its face. The Form 8453 will not be issued for electronic filing to individuals filing Form 1040 or Form 1040A until 2017.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8453-F, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8453-F online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8453-F by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8453-F from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing What is the Form 8453